When home owners go through their process in regards to hiring a contractor, they’ll look at reviews, pictures of previous jobs, and some may even go a bit further and ask for references. But one major item that is often overlooked is insurance. And not just general liability, but workman’s compensation insurance. Liability and workers’ comp are two different types of policies, but each should be carried by nearly every contractor. General liability protects their business and workers if they damage a home owner’s property, cause bodily harm, or advertise injury. Workers’ comp is an insurance policy that protects workers and pays for any harm or injury that comes to them while on the job. As a home or business owner employing the contractor to perform work, it’s up to you to ask and verify if they have proper liability and workers’ comp before signing the contract. Otherwise, you could be held responsible for the alleged wrongdoing or accidents caused by the contractor’s work without insurance.

Many home and business owners fail to realize that the contractor themselves and each of their employees could potentially file a claim against their insurance policy if an accident should occur. Not only does that mean you’re potentially responsible for paying out the appropriate fees and deductibles on such claims, but it guarantees your home insurance rates will go up. Another risk you potentially face when hiring a contractor without proper coverage is that any faulty or defective work they complete will be your financial responsibility to fix. When your contractor has liability and workers’ comp, you have recourse to file a claim against their policy for any repairs. But when they don’t have these coverages, you’re accepting the risk that you’ll be put in the position to pay for future related repairs

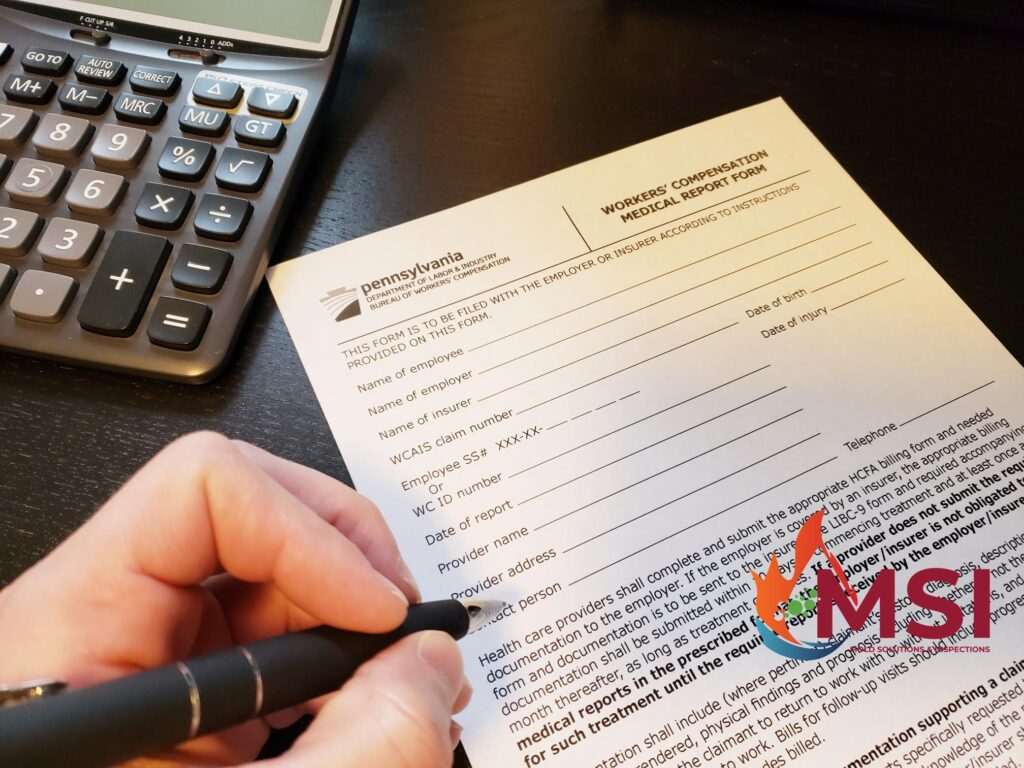

For contractors, liability and workers’ comp are like any other insurance policy in that you are paying to protect yourself from potential damages and economic losses that could potentially occur. If an employee should be hurt on the job, workers comp insurance will cover those losses, rather than it being an out of pocket loss. For homeowners, verifying the contractor you hire is covered could be the difference between having their policy pay for any damages and injuries, versus them looking for your insurance, or even you to pay those costs. Always ask for liability and workman’s comp proof of insurance before signing any contract, and call the carrier to be certain that the coverage is active, up to date and covers the type of project you hired them for.